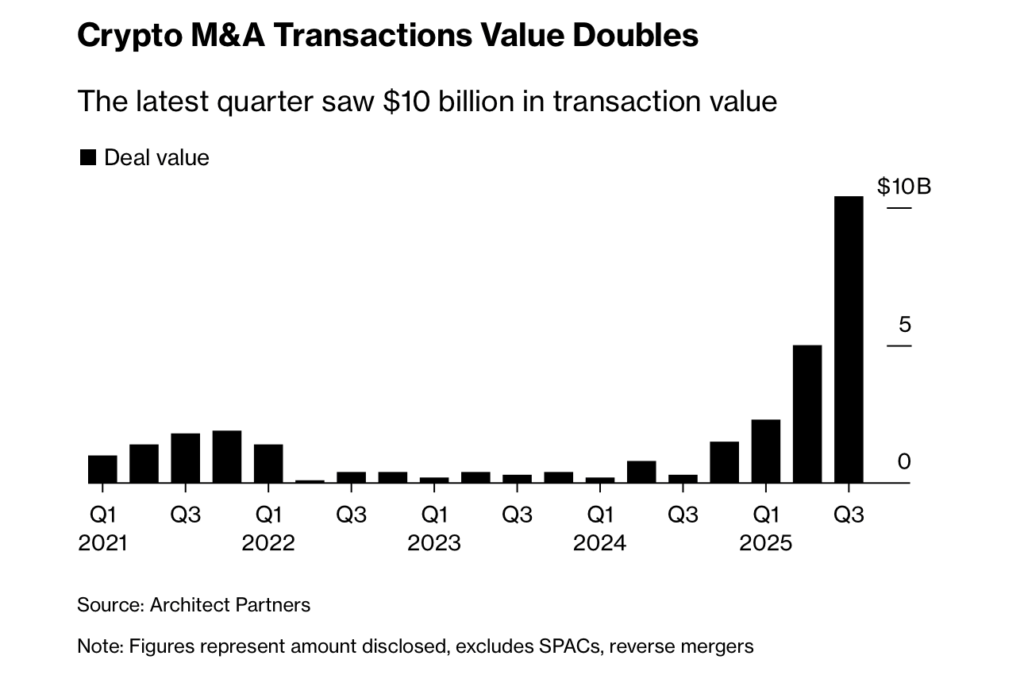

Crypto takeover deals have fully migrated to Wall Street territory — surpassing $10 billion in Q3 alone, a 30x increase year-over-year, according to Bloomberg data.

Bloomberg reporters Isabelle Lee and Suvashree Ghosh note that this surge marks a clear transition for the industry: moving away from small, experimental startups and into the hands of major institutional finance. Deals tracked by Mimar Partners include:

- FalconX acquiring 21Shares — boosting its structured crypto product offerings in global ETF markets

- Ripple purchasing GTreasury for $2 billion — signaling an aggressive expansion into enterprise liquidity and payment infrastructure

- Coinbase buying Deribit for $2.9 billion — gaining control of one of the world’s top crypto derivatives venues

Screenshot Source: Bloomberg.

Why This Wave Is Happening Now

Analysts say that regulatory loosening under President Donald Trump has opened the M&A floodgates. Firms are now racing to secure market share before traditional banks fully mobilize:

- Wall Street giants like Goldman Sachs and Citibank are monitoring these moves closely

- Crypto-native companies want to scale rapidly before stricter licensing and capital rules return

- Access to public markets and ETF inflows has dramatically increased acquisition firepower

In other words, the competitive landscape is shifting from “crypto vs. crypto” to crypto vs. global finance.

Bigger Picture: Strategic Consolidation

As institutional capital pours in:

- Custody, derivatives, and tokenization platforms are becoming prime takeover targets

- Brand assets — including premium crypto domains — are being viewed as scalable growth accelerators

- M&A is evolving into a survival strategy, not an expansion luxury

Many investment banks now expect the crypto acquisition cycle to mirror the early internet consolidation era, where dominant ecosystems were formed in just a few years