Bitcoin Slips to Around $107,500 as Altcoins Face Sharper Losses — Warning Signs Emerge in Crypto Markets

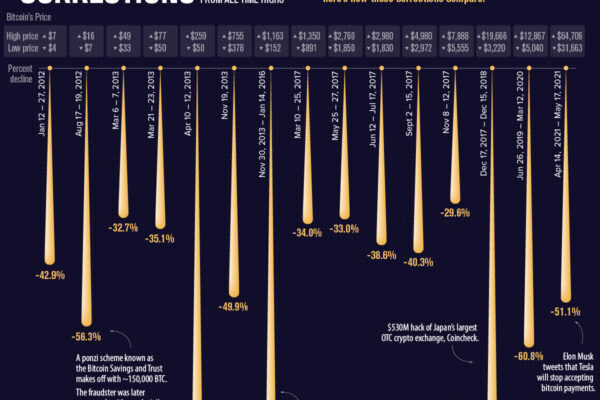

Bitcoin has retreated to roughly $107,500, signaling renewed caution across digital asset markets. Major cryptocurrencies like Ethereum, XRP, BNB, and Solana saw even steeper declines, deepening market anxiety. Analysts suggest this pullback could mark the start of a short-term correction after months of overheated trading. Falling trading volumes and weakening investor sentiment are seen as…